Forex often resembles a poker game. The Fed is betting, and investors are trying to determine whether the central bank is bluffing or not. The EURUSD fall following the results of the September FOMC meeting was not based on the fact that 12 out of 19 officials expect an increase in the borrowing cost in 2023 to 5.75%. The market doesn’t believe it. Another thing is that the updated forecasts suggest fewer acts of monetary expansion next year.

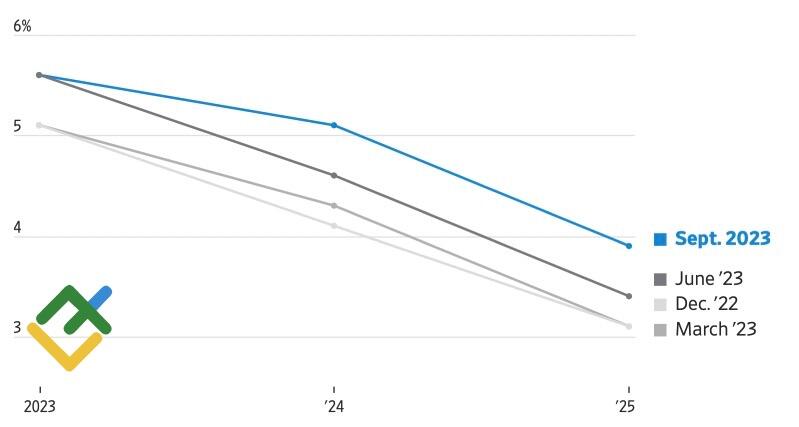

The Fed has made it clear that the victory over inflation has not yet been achieved. Most FOMC officials tend to think that there will be a new step of 25 bps on the way to monetary tightening. The central bank does not expect inflation to return to the 2% target earlier than 2026. Fed officials expect it at 2.6% by the end of next year. As a result, according to the updated forecast, the federal funds rate at the end of 2024 will be in the range of 5-5.25%, and not 4.5-4.75%, as previously assumed.

Fed forecasts for the Federal Funds rate

Source: Wall Street Journal.

The desire to keep the idea of raising the borrowing cost to 5.75% relevant is understandable. If the Fed does not do this or announces the end of the monetary restriction cycle, investors will immediately start discussing rate cuts. This will drop the yield of treasuries, raise stock indexes and weaken the US dollar. As a result, financial conditions will become less tight, and the fight against inflation will be more difficult.

The market called this bluff, but the longer stay of the borrowing costs at a high level was a surprise. A couple of weeks ago, derivatives signaled a reduction in the federal funds rate to 4.5% in 2024 (100 bps down from the current level). After Jerome Powell’s press conference, the figure rose to 4.8%. This is not 5.1%, as the average September FOMC forecast provides, but it is already close to it.

Market expectations for the federal funds rate

Source: Bloomberg.

The fact that the Fed is by no means predicting a recession, as well as Jerome Powell’s speech, intensified the EURUSD sell-off. The chairman of the Federal Reserve noted that the American economy is strong. If it is stronger than expected, the central bank will have to do more to bring inflation back to the 2% target.

The Fed’s hawkish pause has achieved its goals. The continued intrigue about further monetary tightening strengthened the US dollar. Although investors believe that this is another bluff of the Federal Reserve. Unlike Jerome Powell, Christine Lagarde made it clear that she considers the current level of the deposit rate acceptable. Investors realized that the cycle was over and started selling euros on expectations of monetary expansion.

Weekly EURUSD trading plan

The Fed did not repeat the ECB’s mistakes. After its meeting, EURUSDshorts entered at 1.0715 and added up at 1.065 look convincing. Hold them. The level of 1.059 serves as the initial target.